-

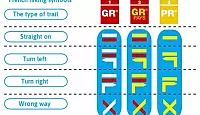

GR, GRP, PR: What do the French hiking signs mean?

What are the coloured symbols on French hiking routes? Who paints them there and why?

-

Miss France: glam - but not sexy

Miss France organiser Geneviève de Fontenay fears she is fighting a losing battle to protect her 'Cinderella dream' from vulgarity

-

Normandy Landings visit for Queen

Queen Elizabeth has confirmed a state visit to France, ending rumours she is handing over duties to Charles

Keep auditors and accountants apart

Unlike in the UK, French accountants and auditors are totally separate professions.

Accountants in France - known as experts-comptables - look after company books and draft financial statements for all types of businesses.

These are mostly small or medium-sized firms or small not-for-profit organisations.

They also give advice on how to set up a business and deal with business tax and payroll issues. It is not so common to consult an expert-comptable for private individual tax issues.

Accountants are also used by politicians in recording campaign funds. They are not allowed to handle cash issues, to act as a trustee or to be involved in insolvency issues (liquidations etc).

Unlike the accountancy profession in the UK which has six main bodies each issuing their own qualifications, there are just two relevant professional bodies in France.

Accounting in France is government-supervised and the professional bodies do not deliver their own accounting qualifications - they are delivered by the state.

France is the only country in Europe in which auditing and accounting are treated as different activities and professions, even though one person may perform the two roles, “wearing different hats.”

The national accountancy body, le Conseil Supérieur de l'Ordre des Experts-Comptables (CSOEC), falls under the jurisdiction of the Ministry of Finance while the national auditing body, la Compagnie Nationale des Commissaires aux Comptes (CNCC), falls under that of the Ministry of Justice.

Experts

About 85% of registered experts-comptables are also auditors and all auditors are accountants. The activities are separated to ensure the independence of the statutory auditor by making sure that he or she cannot provide an auditing client with accountants’ services like advice on tax, pay roll, personnel management, social security, pensions and corporate law.

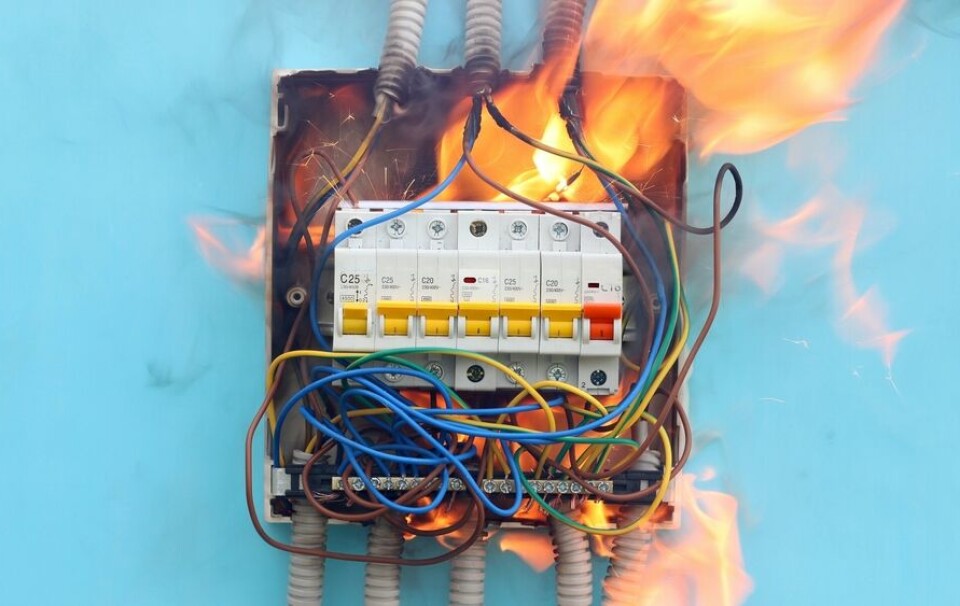

A statutory auditor may not act simultaneously as a chartered accountant for a given client. Furthermore, firms are restricted from providing non-audit services to audit clients. These restrictions help to prevent financial accounting scandals such as Enron, WorldCom or Parmalat, which have had disastrous effects both for the economy and the reputation of the accountancy profession.

There are 32,200 experts-comptables for 1.5 million clients and 20,000 statutory auditors in France.

In August 2003, a new supervisory body - the High Council for Statutory Auditing (Haut Conseil des Commissariat aux Comptes or the H3C) - was created to boost public confidence.

As for chartered accountants, a network formed by both the national and regional accountancy bodies is known as the Ordre des Experts-Comptables (OEC).

At the head of this is the CSOEC, which represents, defends, assists and promotes the standing of France's accounting professionals.

It carries out a parallel role of professional watchdog through an ethics code (revised in 2007), quality control systems, compulsory continuous professional development and disciplinary controls. It reports to the government and coordinates the activities of 22 regional accountancy bodies.

Only accountants registered with the OEC (at national or regional level) are allowed to use the title expert-comptable.

To be registered you must:

- Be fully qualified, having either obtained the DEC (Diplôme d'Expertise Comptable) or an approved EU equivalent supplemented by an aptitude test in relevant French law.

- Be currently engaged in accounting practice.

Membership of the OEC ceases once a person leaves their practice or if they are struck off for professional misconduct.

Each regional accountancy body conseil regional is responsible for managing its own register (tableau) of accountants. If you are looking for an expert-comptable in your area, you should contact your local body.

A list of all OEC regional bodies is available at www.experts-comptables.fr under the title annuaire des conseils régionaux.

Potential accountants must complete five years of university accountancy studies and then three years’ work experience as a professional trainee in an accountancy firm.

During these three years, the trainee must complete a 100-page dissertation on an accounting topic. He or she then qualifies with the DEC.

Statutory auditors must also pass this diploma and show that their three years' experience included auditing.

This contrasts with the UK's system, where accountants do a three-year degree, which may not be in accountancy, before joining a firm and undertaking accountancy studies and exams outside their day-to-day work.

A qualified and registered expert-comptable can work as an independent practitioner or in a large accounting or auditing firm or other large company.

In the latter case, often only certain senior people will be registered, and other workers, while having done accountancy studies, will be known only as accountancy collaborators because of the fees incurred by being registered.

The collaborators can work on accounting and tax matters but cannot sign off the work delivering a final guarantee/certification of it.

There is no database of English-speaking accountants, however we recommend you contact your regional body for advice.

As for accountants’ fees, there are no set tariffs such as those used by notaires.

Experts-comptables are free to set their own charges depending on their overheads and clientele.