-

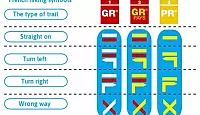

GR, GRP, PR: What do the French hiking signs mean?

What are the coloured symbols on French hiking routes? Who paints them there and why?

-

Miss France: glam - but not sexy

Miss France organiser Geneviève de Fontenay fears she is fighting a losing battle to protect her 'Cinderella dream' from vulgarity

-

Normandy Landings visit for Queen

Queen Elizabeth has confirmed a state visit to France, ending rumours she is handing over duties to Charles

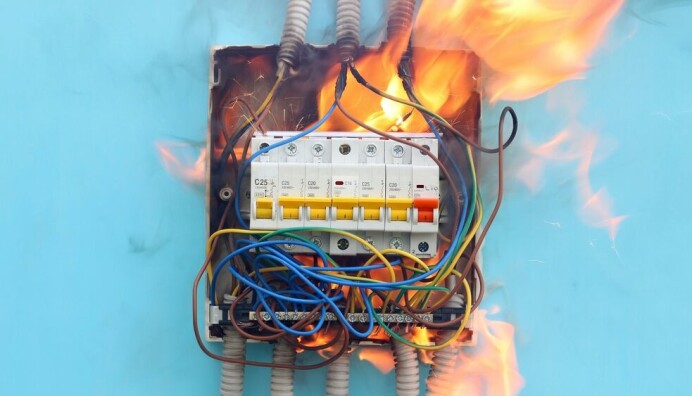

Mortgage taps are turned on

Finance should no longer be a problem for anyone looking to buy a new property

FINANCE should no longer be a problem for anyone looking to buy a new property, providing they have all their details in order.

Mortgages are becoming more freely available, despite low interest rates. Finance brokers Empruntis say it is possible to get a fixed 3.4 per cent mortgage rate over 15 years and 3.55 per cent over 20 years “with a beau dossier”.

The changes have come as the banks have started to free up credit with the easing of the financial crisis and is a welcome boost for people who had plans disrupted by the restrictions.

Empruntis spokeswoman Mael Bernier said that there was even competition between the banks again and it was possible to get a loan with just a 10 per cent deposit, or even no deposit at all, as long as their financial situation was otherwise solid.

Borrowers were also now looking to renegotiate their credit, said Cafpi finance network chief Philippe Taboré and, if they could not get what they wanted, were confident enough to take their business elsewhere.

Empruntis said 45 per cent of the demand for credit was from people looking to refinance away from high-cost loans and said anyone with a mortgage dating from 2007-09 should take financial advice.