-

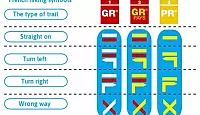

GR, GRP, PR: What do the French hiking signs mean?

What are the coloured symbols on French hiking routes? Who paints them there and why?

-

Miss France: glam - but not sexy

Miss France organiser Geneviève de Fontenay fears she is fighting a losing battle to protect her 'Cinderella dream' from vulgarity

-

Normandy Landings visit for Queen

Queen Elizabeth has confirmed a state visit to France, ending rumours she is handing over duties to Charles

Tycoon has Belgian inheritance scheme

Multi-billionaire Bernard Arnault has created a foundation that could help his children bypass French inheritance tax

FRANCE’S richest man has set up a Belgian foundation which could help his children pay minimal inheritance tax after he dies.

Bernard Arnault, whose fortune is around €32billion, caused controversy recently by announcing he is taking Belgian nationality.

Now the situation has taken a new twist, with the revelation of his having created a structure which could potentially allow him to pass on billions of inheritance with no or very little tax.

The details have been publicised by a Belgian far-left party, Parti de Travail de Belgique (PTB), which has pointed to the statutes of the foundation, called Protectinvest, in the Belgian government’s official journal of record, Le Moniteur Belge.

By placing his assets in such a private structure and allowing third parties to manage it, it is said that a business leader can avoid his empire being broken up after his death in the case of a dispute between heirs, since they can benefit from an income from the business group without running it.

However such a foundation can also help to avoid inheritance tax for the heirs, the PTB said. For this Arnault would have to place assets in the foundation then give certificates to his children via a donation with the help of a notaire.

According to Le Figaro the effect is that if the giver lives longer than three years then direct heirs pay no inheritance tax and after this they would pay 3%, compared to 40% in France; however Arnault and his heirs would have to become Belgian tax residents for these to apply.

Arnault was asked by Belgian paper Le Soir to clarify why he set up the foundation, but he declined.