-

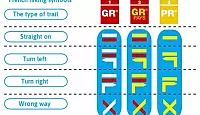

GR, GRP, PR: What do the French hiking signs mean?

What are the coloured symbols on French hiking routes? Who paints them there and why?

-

Miss France: glam - but not sexy

Miss France organiser Geneviève de Fontenay fears she is fighting a losing battle to protect her 'Cinderella dream' from vulgarity

-

Normandy Landings visit for Queen

Queen Elizabeth has confirmed a state visit to France, ending rumours she is handing over duties to Charles

Is UK pension taxed gross?

I would like to enquire whether tax on UK Old Age Pension is taxed gross using the DSS information form.

I would like to enquire whether tax on UK Old Age Pension is taxed gross using the DSS information form.

An “official rate” of exchange is then applied to this information. For the 2006 return, this resulted in a taxable sum about €900 more that I actually received.

The return for 2007-2008 will be even more unfavourable due to the weak Pound. This way of calculating tax must be affecting many people? Anon

The UK Old Age pension is always paid without the deduction of income tax, in other words it is paid gross, and it is deducted from any personal allowances to which you may be entitled as a UK tax resident, reducing these allowances or even making them negative.

The sterling amount received during the French tax year, being the calendar year, is then converted into euros at the average exchange rate for the year.

Accordingly, yes, it is possible that the resultant amount in euros could be more than what would have been actually received if doing the conversion on the day the pension payments were received in sterling.

While the amount you mention seems to be exceedingly high as a difference for the Old Age Pension, perhaps an incorrect rate was used or applied, and hence why it may be better to have the UK Old Age pension paid directly to your French bank account in euros.

All this said, it is a choice: either you control the rate of exchange in practice, to then be assessed on an average exchange rate for the year; or you loose control of the exchange rate and are assessed on what you actually receive.