-

Medical fees, eco-grants, gas prices: 5 changes this May in France

We also include the French income tax declaration deadlines for residents and second-home owners and other dates coming up

-

Phone scams, gardening, insurance claims: 5 French practical updates

Our roundup of recent practical articles you may have missed

-

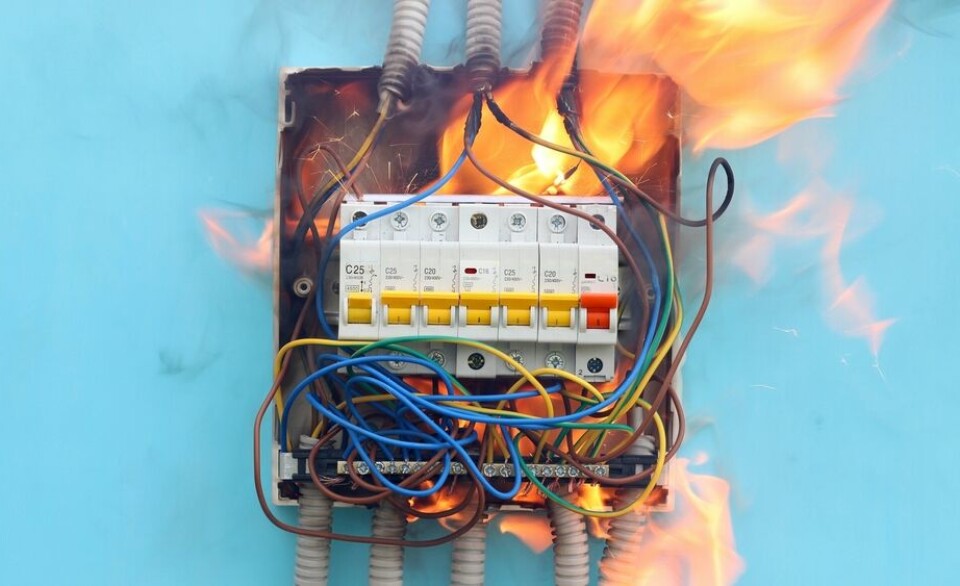

Millions of homes have at least one electrical fault in France

‘Electrical installations age, like cars, and you need to call an electrician to check them’, the national electrical safety observatory warns

Review tax plans for your life in France

Settling into your new life in France involves more than finding your way around, improving your French, making new friends and trying out the local cuisine

You also need to familiarise yourself with local bureaucracy and the complex tax regime and should not leave it too long before reviewing your tax and estate planning.

The rules are quite different here than in the UK. You may need to make changes to protect yourself and your family and to benefit from local opportunities.

Most Britons living in France still own some UK assets, whether it is bank accounts, investments or pension funds. You need to understand how they are all taxed here.

You also need to review tax planning that was set up in the UK, as what was tax-efficient over there is unlikely to be as good over here.

If you fulfil any of the criteria that make you tax resident in France you are liable for French tax on your worldwide income, gains and wealth (the rules outlined in this article are those for residents of France).

Income earned in the UK is, in most cases (bank interest being a key exception), also liable to tax in the UK. You need to look at the France/UK tax treaty to establish what happens about double taxation.

You should not have to pay tax twice, but the income needs to be declared correctly in both countries.

In certain circumstances the income is not directly taxable in France, but you still have to include it as part of your taxable income.

A credit equal to the French income tax and social charges that would have been payable is then deducted from your final tax liability. In other cases, such as with UK dividends and real estate gains, tax paid in the UK may be offset against the tax liability in France.

Remember that, with global automatic exchange of information under the Common Reporting Standard in place, the French tax authorities will receive information on your UK financial assets and income. So, make sure you are following the rules correctly and declaring income in the correct country.

Investments

For UK residents, income derived from ISAs and Premium Bonds are tax-free in the UK. This advantage is lost as soon as you become resident in France as these investments are fully taxable here. In fact, this is a prime example of the risks of holding on to UK tax planning arrangements and not checking the French situation.

In France, until the end of 2017, investment income was taxed at the progressive rates of income tax. With effect from January 1, 2018, it is instead subject to a flat tax rate of 30%. This includes both income tax (12.8%) and social charges (17.2%).

Households in low-income brackets keep the option to choose the scale rates of income tax.

There are very tax-efficient investment vehicles available to residents of France that can reduce tax and social charges liabilities. They may also help minimise succession tax and can be useful for estate planning too.

Pensions

Pension income from UK funds is generally taxable only in France, and is taxed at the scale rates of income tax, up to 45%. There is a 10% deduction (up to a maximum of €3,752 per household).

Government service pensions are a notable exception: If your pension arises from UK government employment, UK tax will always be payable (unless you transfer out before it commences and usually before age 59).

Although government service pensions are not directly taxed in France, the income must be included as part of taxable income. This still applies even if no actual tax is paid in the UK.

While UK residents can take a tax-free ‘pension commencement lump sum’ of up to 25% of their UK pension fund, a lump sum distribution received by a French resident will be treated as pension income in France and hence attract French taxes (i.e. there is no tax free element). This applies whether the monies are paid into a French or UK bank account.

There is an exception for withdrawals made because of an ‘accident of life’.

That said, if you have not yet drawn benefits and you are resident in France, you may be able to cash in your entire UK pension fund as a single lump sum under ‘flexible drawdown’.

Providing certain conditions are met, you could benefit from a special tax rate of just 7.5%.

Note that all pension income (including the lump sum) also attracts annual social charges of 9.1% (increased from 7.4% last year), unless you hold an EU Form S1 or do not have access to the French healthcare system.

Real estate

If you own property as an investment, whether in France, the UK or elsewhere, you need to be aware that the new form of wealth tax, called Impôt sur la fortune immobilière, now only applies to real estate assets, putting these investments at a genuine disadvantage tax wise.

From January 2018, savings and investments are no longer liable to wealth tax. You will only have to pay this tax, though, if your combined worldwide property is valued at more than €1.3 million.

Rental income from UK property remains taxable in the UK. It is not directly taxed in France but you still need to declare this income as part of your taxable income for the year (as mentioned above). If you rent out French property, income is taxed at scale rates of tax, plus social charges which are set at 17.2%. Rental income does not benefit from the new flat tax of 30%.

It is definitely worth reviewing how you hold your assets once you move here to check if you are holding them in the most tax-efficient way for France. Re-structuring could prove profitable.

French taxation can be complicated enough, cross-border taxation and international tax planning even more so, so it is as well to take a good long hard look at your planning.

This article is by Bill Blevins of Blevins Franks financial advice group who also writes for the Sunday Times on overseas finance. He is co-author of the Blevins Franks guide to Living in France.www.blevinsfranks.com

Tax rates, scope and reliefs may change. Any statements concerning taxation are based upon our understanding of current taxation laws and practices which are subject to change. Tax information has been summarised; an individual is advised to seek personalised advice.