-

Income tax bands in France for declarations in 2026 (for 2025 income)

The thresholds are usually updated each year in line with inflation

-

Why more than half of French households do not pay income tax

Tax credits, ‘parts’ system and tax band increases all play their part

-

What is new as French income declarations open online

Updates were given today on property ownership declarations, tax credits and tax for high earners among other points

French tax payments due imminently if 2021 tax-at-source rate too low

If your salary or income increased in 2021 or you were entitled to fewer tax credits than in 2020, you may owe money to the tax administration

Around 10.7 million households will have extra income tax to pay this coming Monday (September 26) as a change in their financial situation in 2021 means that their tax-at-source rate was too low for a portion of the year.

This represents approximately €22.5 billion for the national treasury. Earlier this year some 13.7 million tax households, more than a third of the total, received a refund for overpaying in taxes, generating a total amount of €11.5 billion.

Read more: Income tax reimbursements in France: Are you eligible?

Being due the tax administration money in September is unusual and the situation could come about because the person had a salary increase in 2021 or an increase in other forms of revenue, for example foreign pensions and rental incomes on which estimated instalments are paid based on past incomes.

Tax credits are also concerned. Credits or reductions are available if you incur certain expenses such as giving to charity or employing a gardener or cleaner.

Read more: What are the options for employing a gardener in France?

If you had fewer expenses in 2021 than in 2020 relating to these costs and received an instalment of tax credit money earlier this year on the assumption the expenses would be the same, then you will have to pay back any overpayment to France’s tax administration.

For those concerned by these payments: if the amount you have to pay back (reste à payer) is €300 or less, it will automatically be withdrawn from the bank account that you provided to the French tax administration.

If it is more than €300, then it will be withdrawn in four instalments on September 26, October 27, November 25 and December 27.

📅 Impôts sur les revenus 2021 : vous avez un montant à payer ?

— Direction générale des Finances publiques (@dgfip_officiel) September 22, 2022

💡 Vous serez prélevé automatiquement à partir du 26 septembre 2022, en 1 ou 4 fois.

➕ d'infos et explications ➡️https://t.co/rVI9NCXbkN#Impôts #ServicePublic pic.twitter.com/dUSbIVXldZ

Your bank statement will show that the money has been transferred to the DIRECTION GÉNÉRALE DES FINANCES PUBLIQUES with the reference stating: “solde impôt revenus 2021 n de facture xxx”.

You can find out how much you need to pay (if anything) by going to your personal space on the impots.gouv.fr website and consulting your tax notice, which has this information.

If you do need to pay something, make sure there is enough money in your bank account.

What is Prélèvement à la Source? How is the rate calculated?

A wide-ranging tax-at-source system is now in place in France – known as PAS (Prélèvement à la Source). However, despite this an annual tax declaration is still required in the spring for most residents.

This is because the French system is now a hybrid setup involving tax at source alongside some older tax mechanisms. The latter include, notably, the taxation of the household unit as a whole, with relative tax reductions applied depending on family size, as well as various niches fiscales ways of investing or spending which allow people to benefit from reductions to their declarable income or to obtain deductions from their tax bill.

This means the annual requirement of a tax declaration is still in place for most people

Those with French employment income will find their French salaries have been pre-filled on their paper and/or internet tax declaration forms, although this is not for them to be taxed again - it is so that officials can see if your PAS taxation rate is correct.

Any required amendment to the amount of the tax paid at source over the year – refund or top-up demand – will be made once your declaration has been made and your avis d’impôt sur le revenu tax statement has been issued in the summer.

PAS rate

The rate applied is based on your last tax declaration, so for 2022 it is based on your 2021 declaration (relating to 2020 income). In May – June 2022 you will have submitted your income return for 2021 in the usual way and you will have then been given a new rate which applies from September until the end of August 2023

If your circumstances change significantly during the year, you can ask for your new situation to be taken into account and the rate to be changed to make sure at-source payments remain appropriate and there are no large amendments needed later on.

It is now too late to make this update before Monday’s payment is due but going forward in the future it is wise to update your financial situation as soon as you can.

You can do this via your personal space at impots.gouv.fr under Gérer mon prélèvement à la source and Actualiser mon prélèvement à la source.

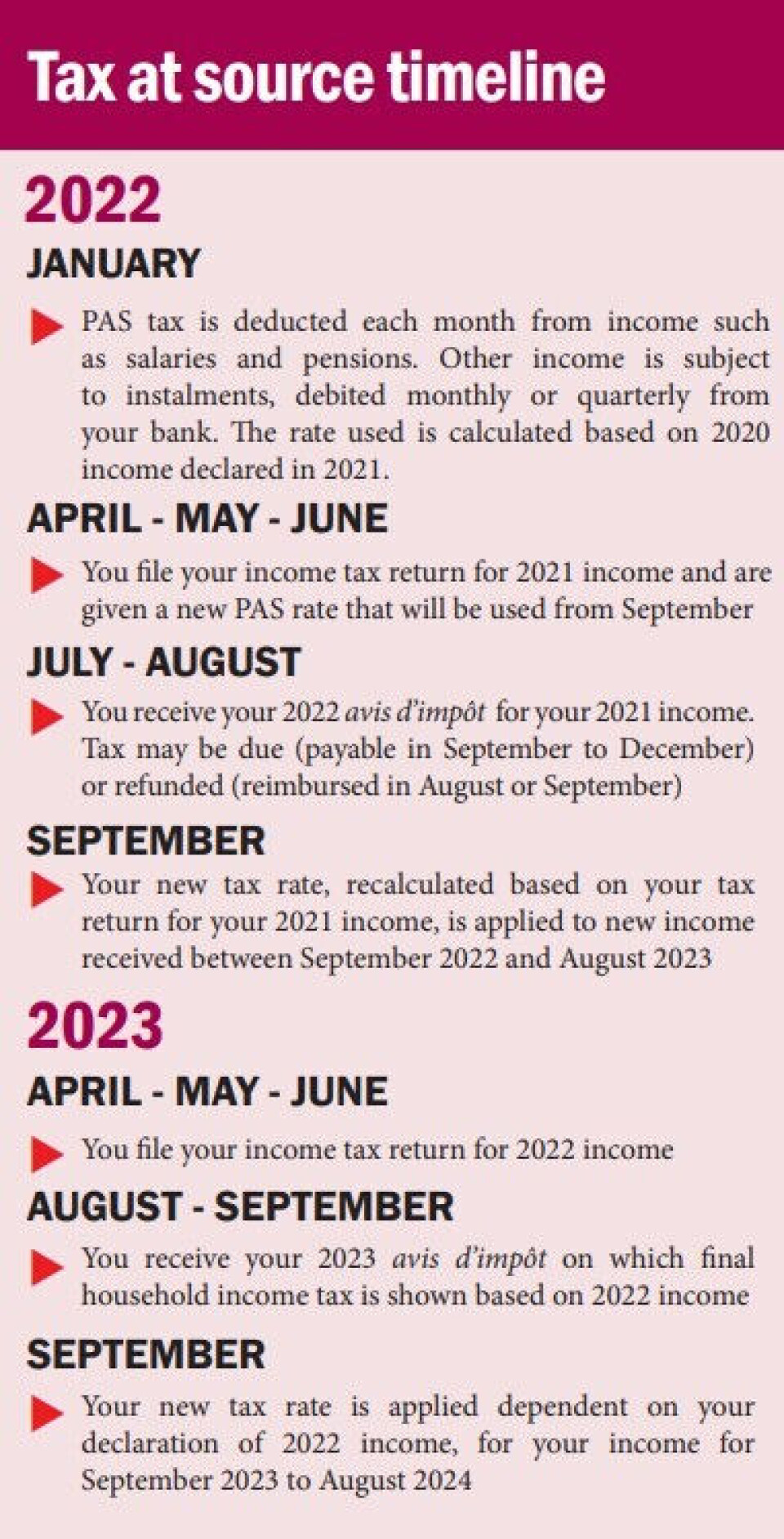

Our graphic below shows a timeline of how the PAS system works, including when certain actions are taken.

Related articles

Income tax reimbursements start in France tomorrow: are you eligible?

Two million independent workers in France to see social charges drop

The truth about French tax residency – forget preconceived ideas