-

€1.2m Dubai case ruling shows importance of knowing French tax residency rules

Couple ordered to pay backdated taxes to France

-

France finally passes 2026 budget - what it means for residents

Budget has measures to help homeowners and low earners but is more punitive to business and local authorities

-

Am I being overcharged on savings in France?

A reader writes about income tax demands on interest

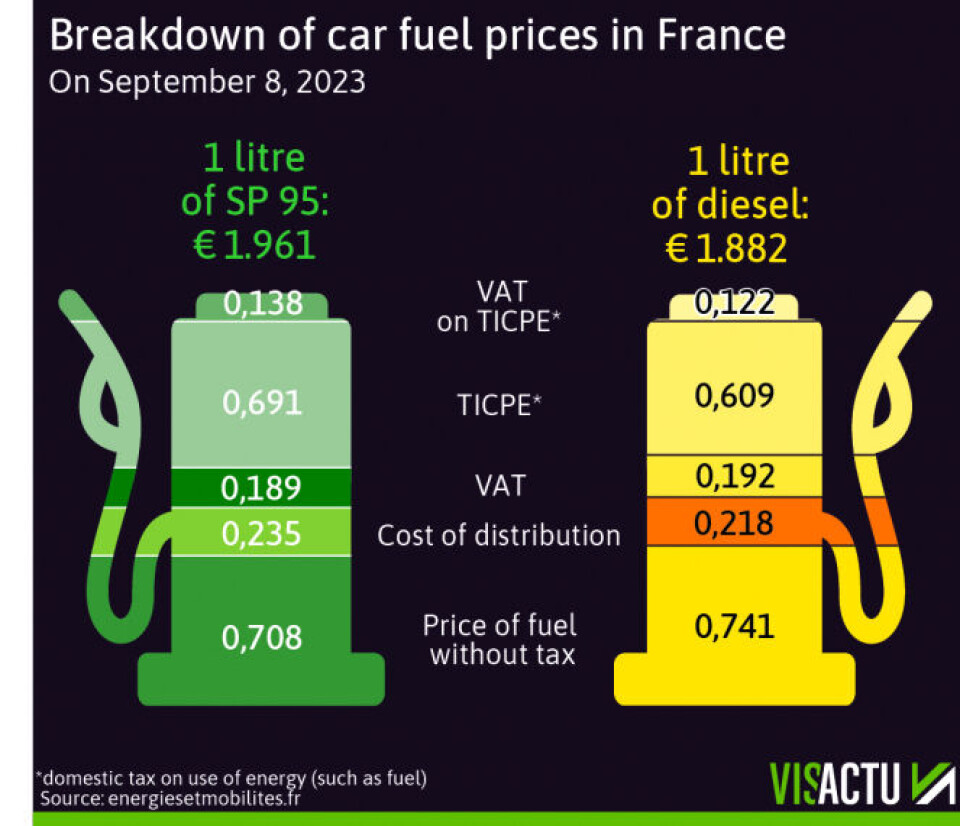

See how much drivers pay in tax when buy petrol or diesel in France

Price at the pump in France is rising but nearly half of the amount paid is tax

Fuel prices in France are rising with many locations reaching the TotalEnergies limit of €1.99 per litre.

The cost of the fuel - whether petrol or diesel - itself only comprises 39% of the price paid at the pump, with an added 11.5% for distribution costs.

The other 49.5% are VAT (around 10% of total price), TICPE – a domestic tax on energy consumption (around 32.5%) – and its associated VAT (around 7%).

Follow this link for a full sized graphic.

Read more:

TotalEnergies to continue cap on fuel prices in France into 2024

Chart: See how France’s inflation compares within the Eurozone