-

Explained: French civic tests for residency and citizenship

Cultural sessions now offered to newcomers undergoing the Contrat d’intégration républicaine (CIR) process via the Ofii immigration service

-

Five-year WA card holders in France reminded to apply for renewal in good time

If you obtained your card in 2021, you should apply to renew it two months before the expiry date

-

Can you offer rentals in France when staying on visitor visa?

There are different thresholds for rentals before they are deemed as ‘professional income’

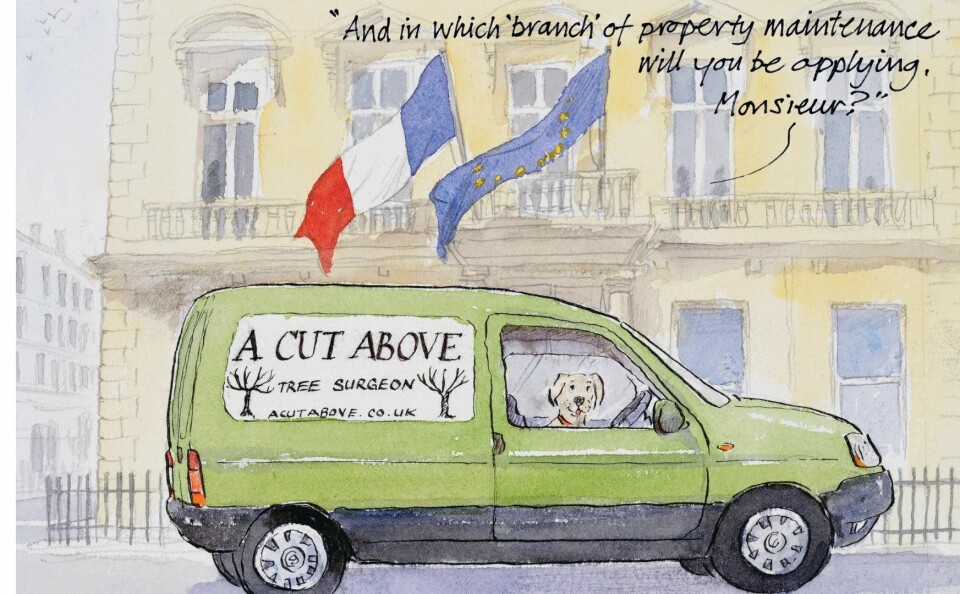

Explainer: which self-employment visa to live and work in France?

We look at visa applications for the self-employed, business start-ups and talent passports

All non-EU people wanting to live and work in France must go through a visa process – with specific ones for people looking to be self-employed.

The main visa for this comes under the heading of entrepreneur/profession libérale, which covers various commercial work, trades and services.

Another possibility, though it is not the main focus of this article, is the passeport talent visa.

Read more: Explainer: what is France’s ‘talent’ visa and who can get one?

Talent passport and setting up a business

It covers several scenarios where the holder is expected to make a significant contribution to the French economy due to a high level of skills or expected investments.

This is possible, notably if you can show you are setting aside at least €30,000 to invest in setting up the business (in this case, the visa heading is création d’entreprise), and you have a diploma related to your business area equivalent to a master’s degree or can show five years of professional experience at a similar level.

Immigration lawyer Paul Nicolaÿ, who works on visa issues in Puteaux, near La Défense, said this is especially suited to setting up a company (société), as opposed to an ordinary sole trader business.

He said that in this case the investment money should be placed in a dedicated account.

The passeport talent can simplify some procedures. It lets you apply directly after arrival in France for a multi-year residency card (up to four years maximum) and bring your partner and children to France.

They also have the right to a four-year visa if they apply within three months of their arrival. It grants your partner the right to work in France, as well as your children (on reaching 18).

Standard self-employment visa implications for spouse and children

In the case of an ordinary self-employment visa, a spouse would come on a visitor status (not allowed to work) if he or she is your dependent, or else should apply for a visa in their own right: for example, because of a job offer or specific skill.

In this case, children who come before age 13 will, on turning 18, also be eligible for a residency card giving a right to work, but this can be a grey area for those who came recently as teenagers.

Prefectures will, in this case, be looking for proof of established family life in France.

Read more: 100 British and 70 Americans ordered to leave France during 2023

How to apply for a self-employment visa

The standard self-employment route is via a visa de long séjour valant titre de séjour (VLS-TS). This allows a year of residency with the requirement to ‘validate’ it on a website within the first three months.

You must apply for a residency card within two months of the visa’s expiry.

The visa and card will say entrepreneur/profession libérale.

Read more: Rules for visiting UK from France with validated VLS-TS visitor visa

Occasionally, a different kind of visa, requiring the holder to apply for a residency card within two months of arrival (but with no validation process) is issued instead.

Whichever route, the process begins with an application via France’s official visa website, which you should start about three months before you aim to travel to France to work.

It is useful to use the ‘Visa Wizard’, which will indicate the supporting documents required.

Select the option of ‘business’ (travail if using the site in French) and either ‘entrepreneur’ or ‘liberal profession’.

The former includes many trades and commercial activities, while the latter broadly refers to more ‘intellectual’ services. These include the traditional professions, such as accountancy and law as well as, for example, being a consultant.

Note that some professions are highly regulated in terms of required qualifications. If in doubt, consult a relevant professional body in France.

Certain professions, including chartered accountancy, require EU/EES citizenship.

An entrepreneur visa is relatively complex and needs preparation

To set up a new business, you must demonstrate relevant knowledge and experience, and the economic viability of your project – essentially, that it will generate at least an income equivalent to the French minimum wage (currently €1,399 net of social charges per month).

A visa fee of €99 is payable.

In some cases, it is necessary to obtain an assessment of the viability of your plans in the region where you want to work. This can take around a month.

Mr Nicolaÿ said: “The entrepreneur visa is relatively complex as it needs a lot of preparation. You have to do a business plan, preferably by a French expert such as an accountant. You should also have a budget forecast, again preferably by a French accountant.

“Documentation made only by yourself carries less weight. You can’t request this visa with vague plans – you need to think things through.”

Take supporting documents and passport to consular services

In many countries, once you have submitted the visa application, you must take supporting documents to an appointment with a contractor for the French consular services.

In the UK, this is TLSContact; in the US, it is VFS Global.

An administration fee is payable, and you have to leave your passport for forwarding to the French consulate.

It can then take a few weeks before – if all is well – the passport is returned with a visa sticker for collection (or courier delivery, at an extra cost).

What to do once in France

Once in France, you must validate your visa (there is a fee of €225) and attend a routine medical with the Ofii immigration service.

You will also be asked to sign a contract stating you adhere to ‘Republican’ values, and take a test to assess whether you have basic French. If not, you will be offered subsidised lessons.

Read more: New tougher French language rules for immigration: who is affected?

You must also carry out business registration formalities via this website.

To remain in France beyond one year, you should apply for a residency card before your VLS-TS expires (via the same website as the validation).

This requires evidence that your business has been set up and is generating income as planned.

Related articles

LIST: what was kept and what was rejected in French immigration law

Do I have to update my carte de séjour if French street name changes?