-

Transavia to replace Air France for Nice-Orly flights

Up to eight return journeys a day to be offered by the budget carrier

-

Is this the end of free mountain rescue in France?

A new report says that charging for services is ‘legitimate and necessary’

-

How France’s new food strategy aims to change the national diet

The plan outlines new goals for meat consumption

Brexit cost couple £47,000 on Aviva first death life assurance policy

The firm said it could no longer ‘carry on business in France’ due to Brexit and is due cancel the policy that the couple have paid into since 1983

Former UK residents in France report problems with UK life assurance policies where the main aim is a payout to help the survivor of the couple.

One couple have been told their policy, held with Aviva since 1992, and since 1983 under prior ownership, is being ended due to Brexit.

French law 'does not permit premium changes' insurer says

They have been paying premiums of £69/month to a policy which would have paid out £47,155 on the first death but have been informed the policy’s cash-in value is £169.26, which is all they can expect to receive.

Vivien Reynolds, from Isère, said she and husband Peter were warned last November that their policy would be cancelled at its next review date if changes were required to be made to their premiums, as French law does not permit this.

However, she said the premiums had not systematically been changed at past reviews. Due to confusion over wording of a previous communication, they also failed to realise the next review was imminent.

Brexit ends ‘financial passporting’

A March 29 letter said the review found Aviva could no longer guarantee both the same level of death benefit and the same premium and thus must close the policy. A previous, January 1, 2021, letter had said Aviva can no longer “carry on business in France” and referred to certain changes that could not be made to policies but cancellation was not mentioned at that stage.

Brexit brought the end of ‘financial passporting’ for UK financial firms, whereby business can be freely conducted in other EU countries rather than being subject to national rules in each EU state.

Some firms sought solutions, including setting up branches on the continent.

No transfer offered to Aviva France

Mrs Reynolds, 69, who is retired from the care home sector, said she is angry at a lack of early warning and options.

She also asks if the policy could have been transferred to Aviva France, which she discovered Aviva sold to a French group last autumn, saying it planned to “focus on our core business in the UK, Ireland and Canada”.

“Why didn’t they have the decency to contact us in the transition period?” she asked.

“The policy is important to our future planning, for funeral expenses and to compensate for loss of incomes.”

Aviva responds

An Aviva spokeswoman said it “would not have been possible to simply transfer a single UK contract to Aviva France”.

She added that the end of the transition period changed how they were allowed to administer policies of customers who bought them in the UK but who are now living in the EU.

French financial regulators brought in rules in December 2020 relating to such policies, she said.

“Under French law, it’s no longer possible to renew, extend or modify existing contracts without regulatory permission to conduct insurance business in France.

“If changes need to be made to a policy, for example, following a review, there is no alternative but to cancel it.”

She said that in January 2021 Aviva outlined to customers its understanding at that time and suggested they took financial advice.

UK Financial Conduct Authority view

According to the UK’s Financial Conduct Authority (FCA), national regulators in the EU were all advised by an EU insurance authority that post-Brexit, UK insurers could continue to service contracts of former UK residents who had moved to the EU provided they were not altered from their initial policy terms. Firms may, however, vary in their interpretation of rules.

An FCA spokeswoman said: “Firms are expected to act in accordance with local laws and local regulators’ expectations.

“Firms need to interpret these laws when determining what ongoing servicing they are authorised to provide on existing policies.

“They may decide removal of a right or an option in a contract is necessary, given their interpretation.

“Where an action is taken that impacts policyholders, we expect firms to consider customers’ circumstances, and communicate the changes clearly.”

Have you had similar problems? Let us know at news@connexionfrance.com

Another couple report poor service since Scottish Friendly took over their policy from Canada Life in November 2019, originally taken out in 1971.

Simon Wollen, 91, from Hérault, says issues with his fully paid-up policy include waiting up to a year to receive an annual statement, not being able to access his online account without a UK postcode, and, having used his son’s, finding valuation information from 1982.

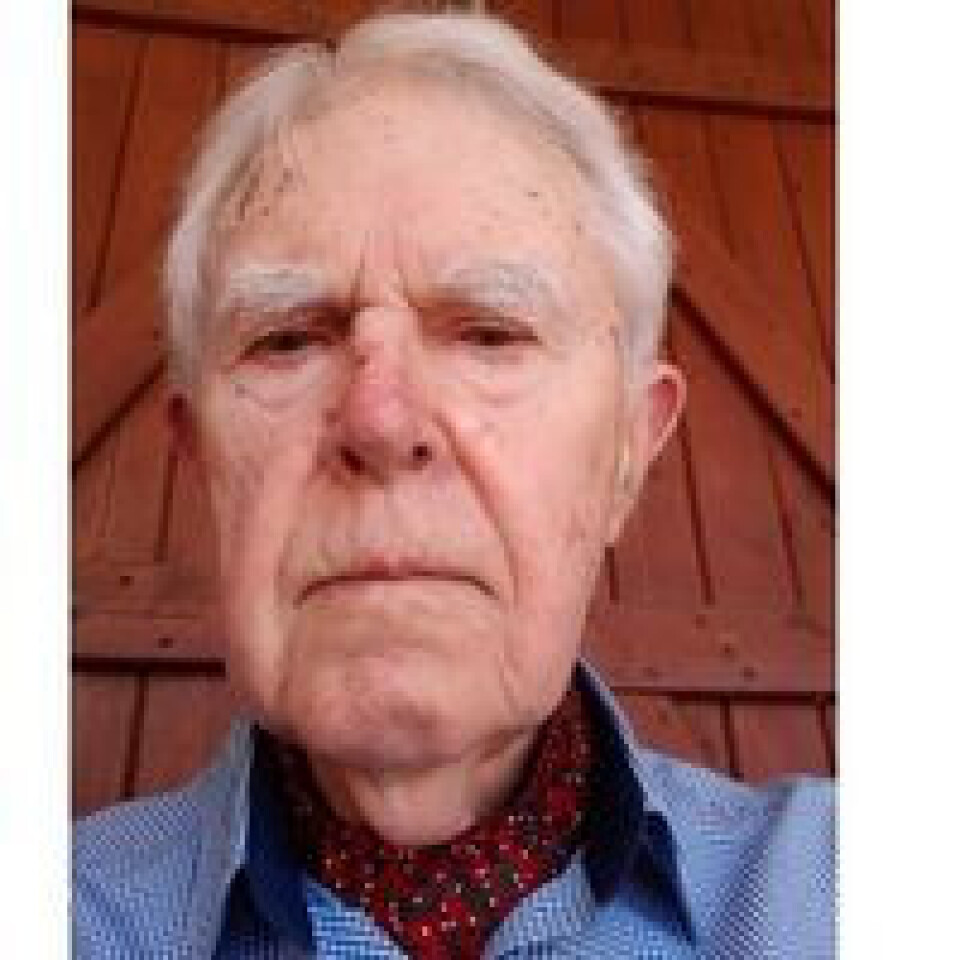

Simon Wollon, 91, concerned over ‘general chaos. Photo: Simon Wollen

The firm’s website says that if people in France have issues it cannot resolve, “you have recourse to the French legal system”.

He said: “The French wouldn’t be interested in a UK policy. I’m concerned about the general chaos. What’s going to happen when I die?”

A Scottish Friendly spokesman said: “We are sorry for the errors that have affected Mr Wollen and would like to again apologise for the distress and inconvenience this has caused.

“We are working hard to put measures in place to ensure these errors don’t happen in the future.”

Related articles

UK pension firm will not pay out to me in France post-Brexit

Best way for Britons in France to manage ‘lump sums’ of money