-

Insurance denied for Britons' French hilltop home due to 'flood risk'

Underwriters decided to end cover linked to alleged proximity to water

-

How to lower the amount you pay for insurance in France

‘Big three’ insurances all set to see costs rise in 2026

-

Mutuelle fees set to increase in France next year: see by how much

New taxes on mutuelle companies denounced by insurance federation

How much has home insurance gone up in your part of France?

Plus we share tips on how to keep your premiums down

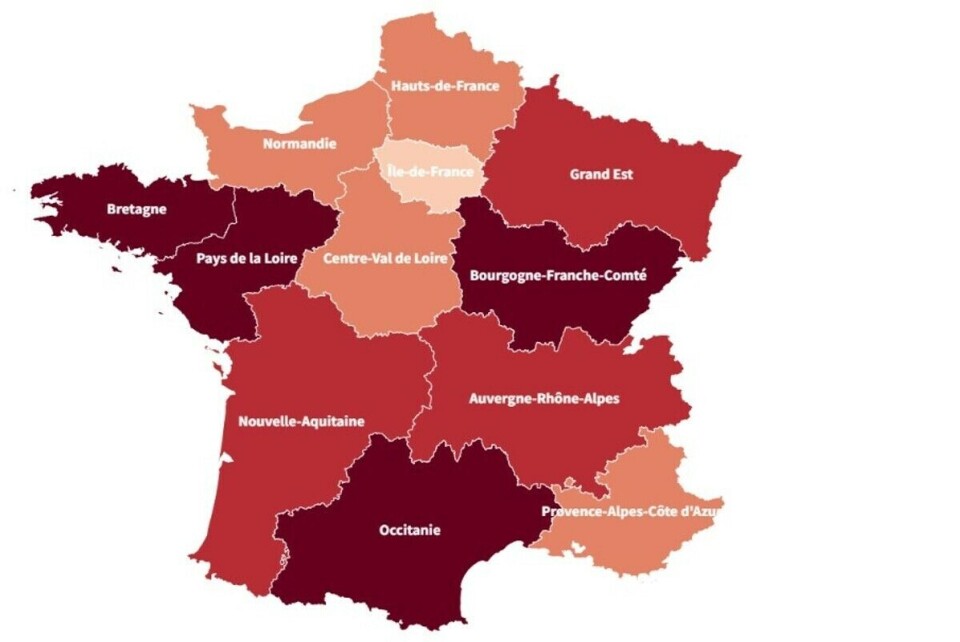

Home insurance premiums in France have risen by 5% this year compared to 2022, according to a new study.

Some regions are more affected than others.

The report, by insurance comparison website Assurland, reveals in Brittany home insurance has risen by nearly 11% year-on-year overall, for an average cost of €189 per year.

Insurers say that the rising prices are due to a sharp increase in the number of burglaries. For example, in Brittany, burglaries have risen by 41%, compared to 11% nationwide, according to Assurland.

The extra costs of climate change-related incidents, such as damage caused by hail or drought, are also a factor, as is high inflation.

Consumer behaviour has also had an impact; more people (56% of people in France) are choosing ‘replace for new’ home insurance policies, which can cost up to 20-25% more but offer more protection in the event of a claim, Assurland said.

Read more: The French cities where home insurance is most expensive

Philippe Assaf, an insurance broker in Poitiers, told FranceInfo: “When insurance companies pay their bills, they are also affected by the whirlwind of inflation too. We are no longer making money.”

He added that insurance premiums could yet rise further as a result of these increased costs.

Read more: Moves to improve compensation for drought damage in homes in France

The rise in 2023 was sharp, but it marks a continuation of a 10-year trend. Overall, home insurance policies have increased in price by 38% since 2010, said Assurland.

Olivier Moustacakis, the co-founder of Assurland.com, said: “After a period of stagnation following the Covid crisis, home insurance rates are on the rise again. They have risen by almost 40% since 2010. 2022 was a particularly bad year, and this is showing at mid-year. We [as consumers] need to step up our prevention efforts, which will help to contain price rises in the future.”.

How can I get a better home insurance deal?

If you are considering shopping around for a better home insurance deal, there are some recommended best practices to follow that can help.

It is also worth knowing that in France, the loi Hamon (Hamon law) allows you to cancel (résilier) your insurance contract at any time, 12 months after you first signed. This means that if you have had the same policy for a year or more, you are free to look for better deals. If you cancel a contract, it should end within 30 days.

Consider the following tips when looking for the best home insurance deal at the lowest cost, suggests finance website izf.net:

-

Choose a basic insurance policy. The more comprehensive, the higher the cost. If you want to save, consider a policy that covers basic risks such as fire, water damage, and natural disasters. This will give you some peace of mind without spiralling costs.

-

Compare offers. Always use online price comparison sites to shop around for the best deal. Examples include Assurland, Les Furets and lelynx.fr. The tools are usually free and allow you to select the level of insurance you need, and compare deals.

-

Optimise your excess payments. The excess is the amount you pay when you make a claim, and increasing it can significantly reduce your premium. In French, ‘excess’ is called ‘franchise’. Consider how much you would be willing to pay when making a claim.

-

Make the most of company deals. Some insurance companies offer better rates to homeowners who take extra measures such as installing an alarm system or extra locks. Many also have no-claims discounts.

-

Get home insurance and other insurance from the same company. Sometimes it can pay off to have your home insurance and, say, vehicle insurance from the same company. They may offer a deal that is cheaper than buying the policies separately.

-

Limit your insured contents. Of course, the higher number of specific, expensive items that you insure, the higher your payments will be. You may wish to reduce the number of high-cost items in your home, not insure them on the same plan, or choose separate insurance for particularly important and valuable items.

Related articles

How to insure and prove value of expensive items at your French home

France home insurance: Do policies pay out for rat damage?

Group buys: ways to reduce home and health insurance bills in France