-

Pistes closed, confinement orders: Alpine resorts deal with avalanche risk

Increased snowfall this weekend may cause further closures as busy school holiday season continues

-

Former French Interior Minister announces 2027 presidential candidacy

Bruno Retailleau recently asked prefectures to be tough on immigration

-

Ryanair axes Dublin-Rodez route but London connection retained

“We are disappointed but had no say in decision” say airport authorities

Brexit VAT mix-up meant double tax bill for glass order to France

Normandy couple were charged VAT on both sides of the channel

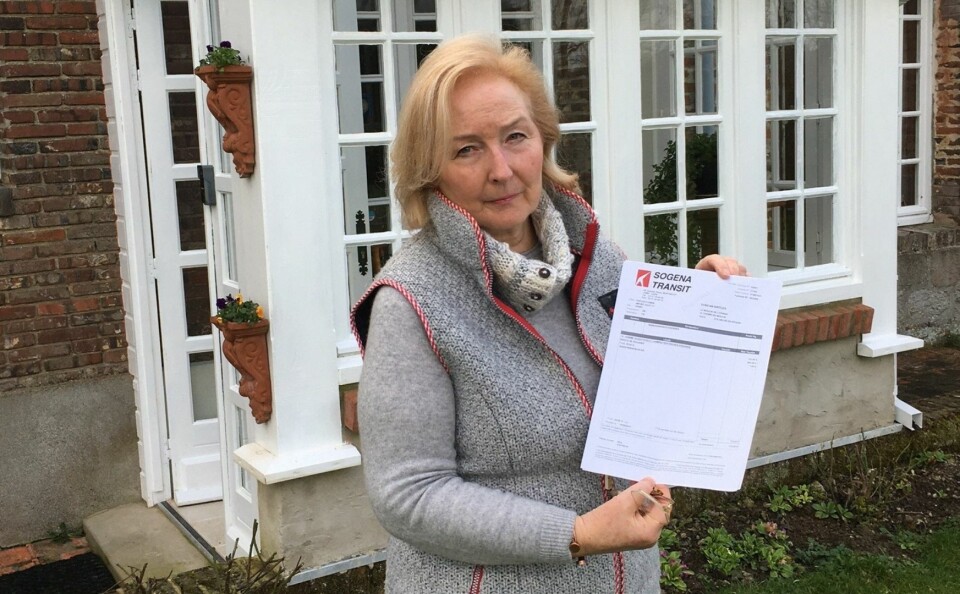

A couple from Normandy who ordered frosted glass panels for a porch roof from a UK supplier ended up with bills for more than twice the cost of the glass after delivery, tax and customs charges were added.

Lynn Birtles, 74, said: “My husband set his heart on this material we could only get in the UK, but we had no idea what we were letting ourselves in for.”

Costs started adding up

The costs break down as: £1,036.82 for materials, plus £684 for the transporter for delivery of a pallet and customs clearance formalities – to which the UK firm added UK VAT, a total of £2,064.98.

The couple then received a further bill from a French customs agent for €155 duty, €562 French VAT, plus an additional €1 fee – a total €718 (£600) on top of the UK bill.

They spoke to the UK firm, which did not know what was going on, Mrs Birtles said. “With Brexit, it seems everyone’s working in the dark.”

UK firm should not have charged VAT

Our investigations show the problem arose from UK VAT being charged unnecessarily.

The French agent, whose fee was part of the delivery bill, said he charged import duty (related to the type of material) on the price billed to the client and French VAT on the price plus duty, as is usual, he said.

He said this can be avoided in such situations by the UK firm not charging UK VAT, which he said is advisable for a distance sale to a resident in France for an item worth more than €150. If UK VAT is charged, the item will still attract French duty and VAT at the border and end up with double taxation, he said.

He said he would explain to the couple.

We will also follow this up to see if a solution is found.

Related articles

Why was I charged for customs and VAT on an Amazon delivery in France?

Crossing French-UK border is now like going to US, say French customs