-

€1.2m Dubai case ruling shows importance of knowing French tax residency rules

Couple ordered to pay backdated taxes to France

-

France finally passes 2026 budget - what it means for residents

Budget has measures to help homeowners and low earners but is more punitive to business and local authorities

-

Am I being overcharged on savings in France?

A reader writes about income tax demands on interest

Draft list of French communes that could face second-home tax hikes

More than 3,500 communes will be able to charge an extra levy from next year

Article published June 20, 2023

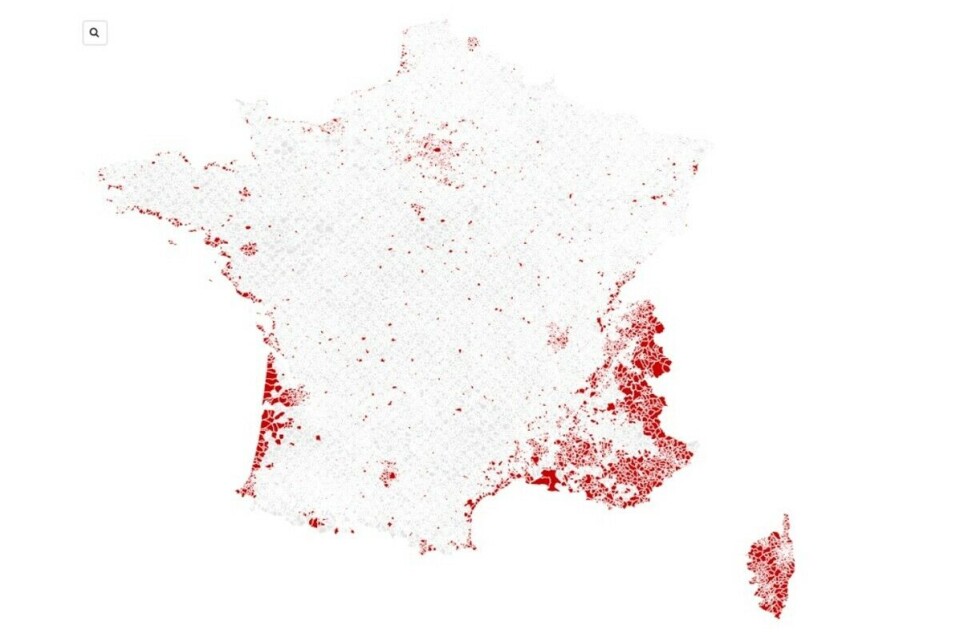

A draft list of French communes that will be able to hike local property taxes has been published.

We reported last week that more than 2,600 new areas of France will be allowed to levy a surcharge on top of the usual taxe d’habitation, which is targeted at second homes.

If the information is confirmed, as appears likely, it means the communes in question can charge from five to 60% more on top of taxe d’habitation on second homes. They do not have to do so, and where they do, it would only apply from 2024’s tax.

Gazette des Communes, a media for local government workers, has published a document from France’s ecological transition ministry detailing the communes affected.

It is only a draft at this stage and it is expected to be published in France’s Journal Officiel in the coming days.

The communes affected are mainly in the French Alps, Corsica and the Mediterranean and Atlantic coastlines.

The same communes are also designated as subject to the taxe sur les logements vacants (TLV, a specific tax on vacant - unused and empty - homes) and having high pressure on housing.

Read more: Second-home owner woe as 2,600 new French areas allowed to raise tax

Which communes are going to be affected?

With the new changes, more than 3,500 communes in France will be able to levy the surcharge.

A number of high-population areas that were already able to apply the charges are shown, including but not limited to:

Paris and the surrounding suburbs, Nantes, Nice, Lyon, Strasbourg, Toulouse, Avignon, Bayonne, Bordeaux, Chambéry, Grenoble, La Rochelle, Marseille, Lille, Montpellier, Menton, Rennes, Saint-Nazaire and Toulon.

The new communes that can levy TLV or implement taxe d’habitation surcharges from 2024 span across all of France, but are concentrated mostly in tourist hotspots.

While a number of communes in larger population centres in the south-east of France were already able to apply the surcharge, that number is now set to greatly increase.

The same applies in the French Alps, which has seen a large number of communes in the Savoie and Haute-Savoie regions added to the list. Corsica has also seen a huge number of communes added.

Most communes which border the Atlantic Ocean, across the Nouvelle-Aquitaine and Pays de la Loire regions, have been added, alongside a number of coastal communes in Brittany which hug either the Atlantic Ocean or English Channel.

A larger number of communes within commuting distance to Paris are now included on top of the immediate suburbs surrounding the capital, alongside communes in Normandy and the north of France.

You can view all of the communes in our table below. Use the search box for the commune you are interested in.

What properties are affected?

Previously, communes were only subject to taxe sur les logements vacants (TLV) and able to levy taxe d’habitation surcharges if they fulfilled two criteria:

- More than 50,000 people live in the commune (or the wider 'urbanised area' that it is part of)

- The housing situation in the commune was classed as being ‘under pressure’ (zonestendues)

Before 2023, this affected 1,140 communes in France, across the country’s principal cities and larger towns, with the number being largely unchanged since its introduction in 2013.

Read also: Taxe d’habitation deadline approaches in France: Who still pays this?

The new changes mean, however, that instead of the previous two criteria required, communes that fulfilled only one element – “a marked imbalance between supply and demand for existing housing, resulting in serious difficulties in accessing housing” – have been given the ability to levy the surcharges.

The changes were made, in part, to help tackle France’s housing shortage, as they ultimately seek to dissuade people from keeping second homes or empty properties in areas where properties – especially for rent – are in short supply.

You can read more about the taxe sur les logements vacants and other second home taxes in The Connexion’s previous article on the alleged changes here.

Related articles

Taxe foncière, taxe d’habitation: how are these worked out in France?

Eight key takeaways from French study into second homes in Brittany